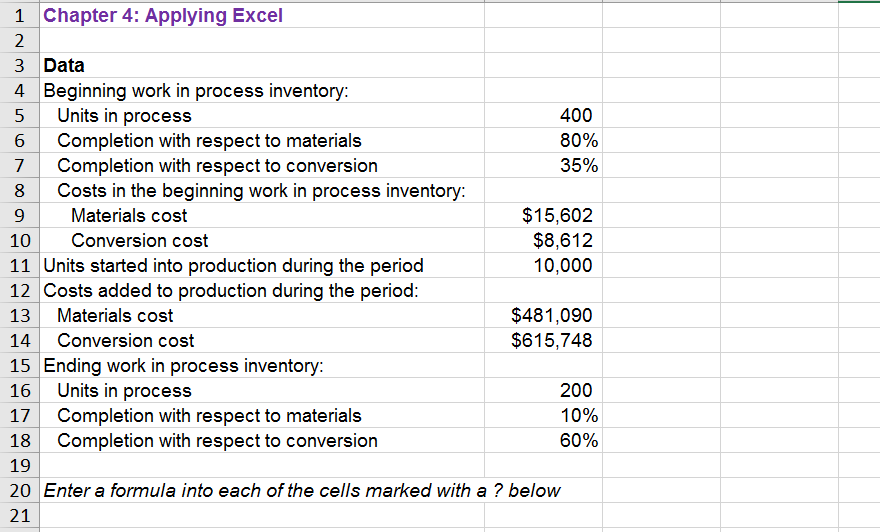

beginning work in process inventory formula

Let say company A has an opening inventory balance of 50000 for the month of July. You must have the previous quarters ending work in process inventory which is carried over as the next quarters beginning work in process inventory.

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com

The manufacturing costs incurred in this quarter are 200000 and the cost of manufactured goods is 100000.

. If your head is spinning with all these figures don. Ad Powerful Business Software Doesnt Need To Break The Bank. The value of that partially.

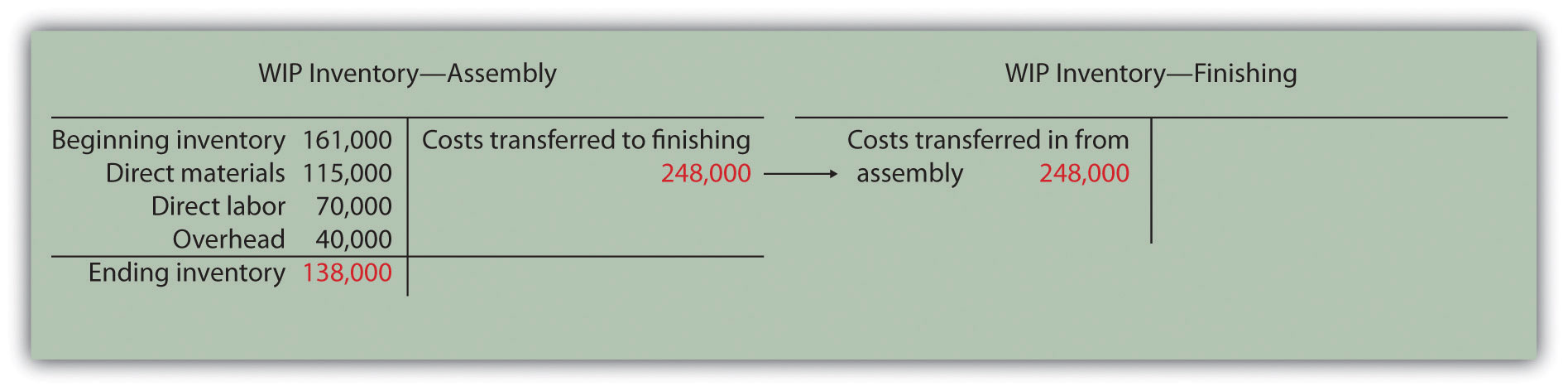

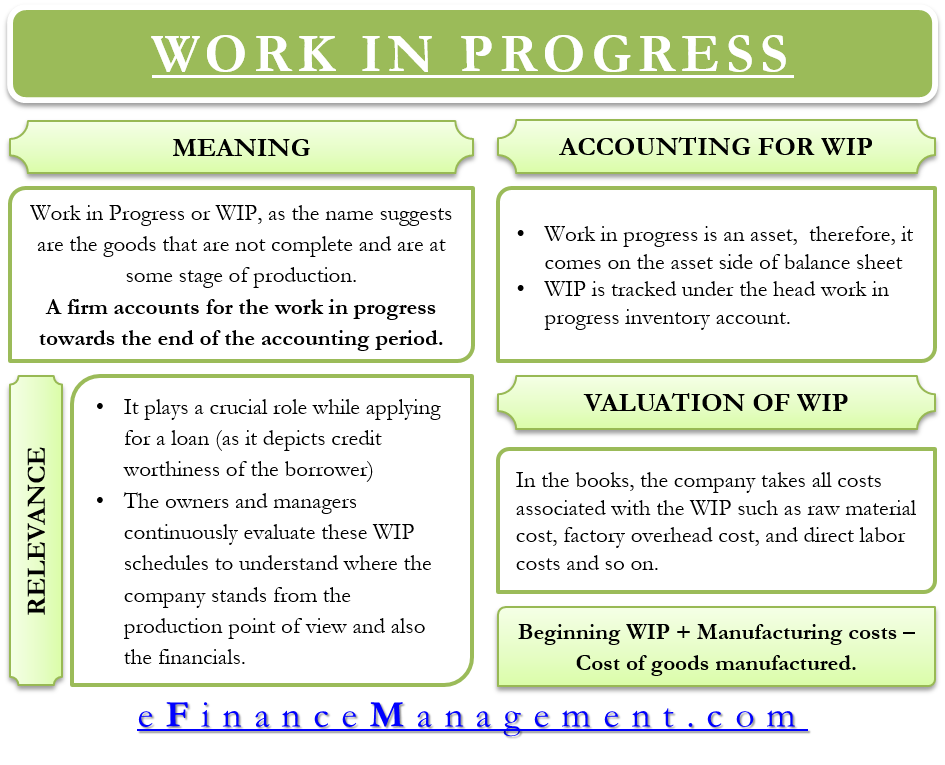

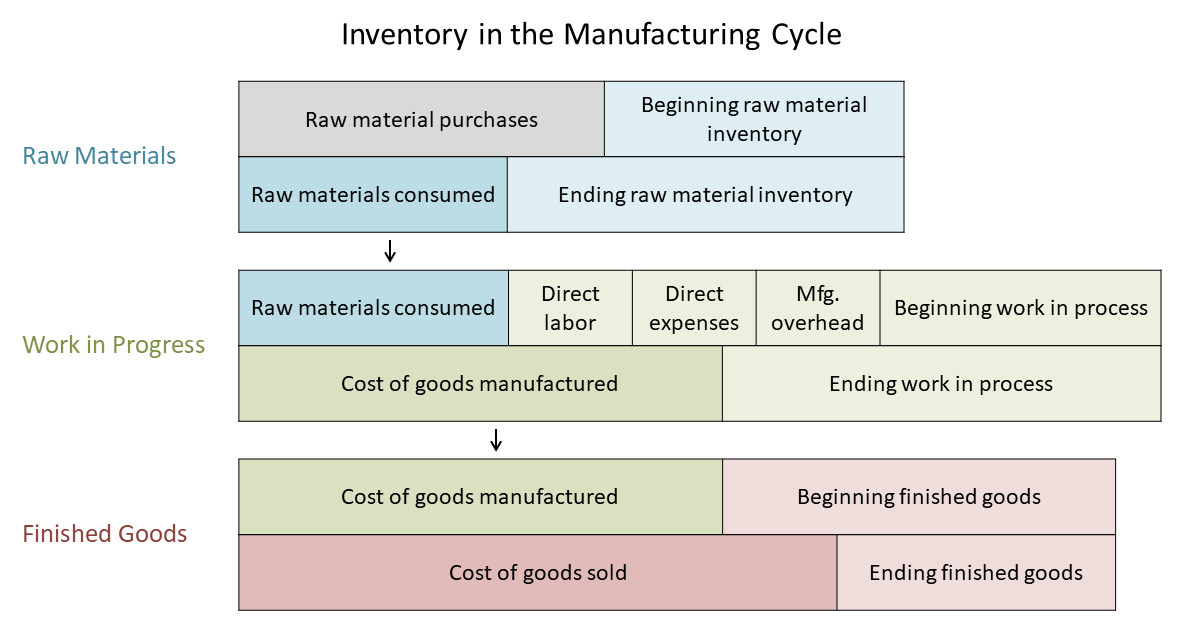

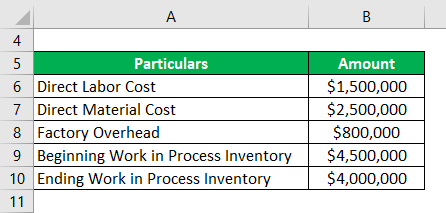

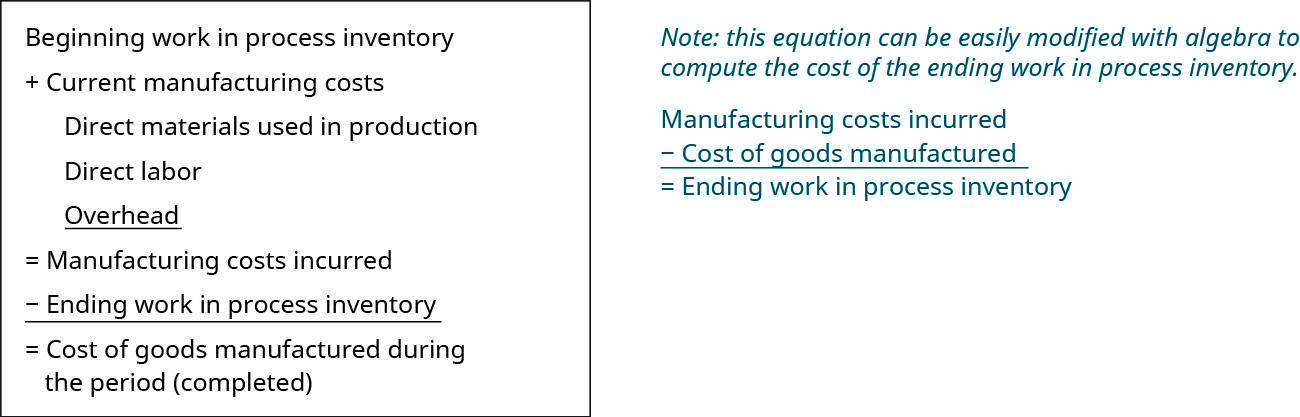

Work-in-Process Inventory Formula. Beginning WIP Inventory Manufacturing Costs COGM Ending WIP Inventory. Companies that manufacture goods can store large amounts of inventory so the formula for calculating WIP is an effective tool for businesses to keep track and manage production costs and inventory.

This is a sum of your raw materials used labor costs and any overhead such as machine operating costs. And C c cost of goods completed AC TCq Fq VC Considering a typical production situation of accepting new orders into a. All The Advanced Features You Need To Run Your Business At A Fraction Of The Price.

If your head is spinning with all these figures don. Once you know your beginning WIP inventory manufacturing costs and COGM you can start to use the WIP inventory formula. Work in process inventory formula.

As determined by previous accounting records your companys beginning WIP is 115000. Work-in-process is a companys partially finished goods waiting for completion and eventual sale or the value of these items. Take A Free Product Tour.

The term is used in production and supply chain management. Work in process inventory formula in action These include raw materials as well as the cost of developing these materials into the final product direct labour costs and factory overheads. Since WIP inventory takes up space and cant be sold for a profit its generally a best.

Next multiply your ending inventory balance with. Lets break down the steps for how to find beginning inventory. Work in Progress WIP Formula.

Calculating your beginning inventory can be done in four easy steps. It is essential for any manufacturing company to know the exact amount of inventory they hold whether it is in terms of raw materials or work in process inventory. Determine the cost of goods sold COGS using your previous accounting periods records.

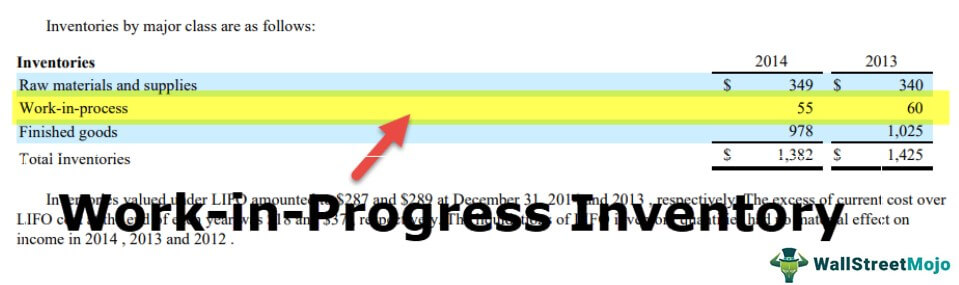

That makes it a part of manufacturing inventory see. During the remaining financial year the company has made purchases amounting 20000 and during that time on the companys income statement the cost of goods sold is 40000. Work in process WIP inventory refers to materials that are waiting to be assembled and sold.

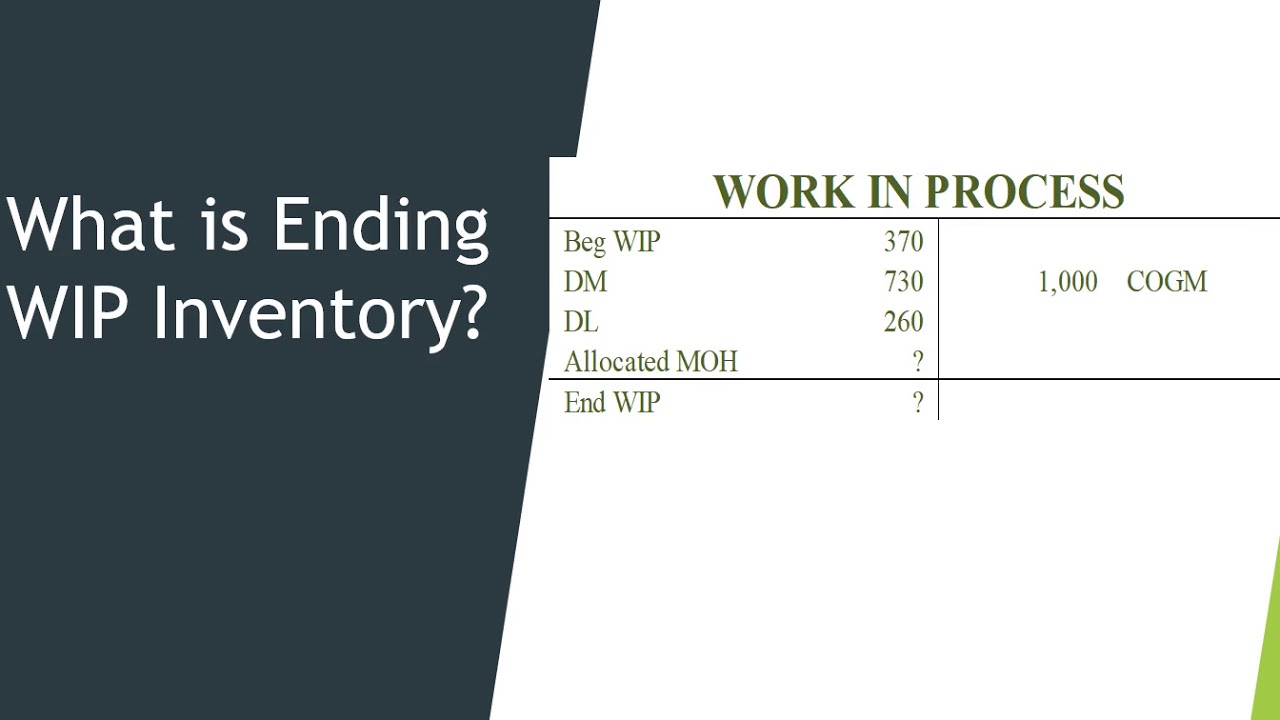

Definition formula and benefits. Work-in-process WIP refers to a component of a companys inventory that is partially completed. The work in process formula is the beginning work in process amount plus manufacturing costs minus the cost of manufactured goods.

The standard work in process inventory definition is all the raw material overhead costs and labor associated with every stage of the production process. The beginning WIP inventory cost refers to the previous accounting periods asset section of the balance sheet. The beginning work in progress WIP inventory is the ending WIP balance from the prior accounting period ie.

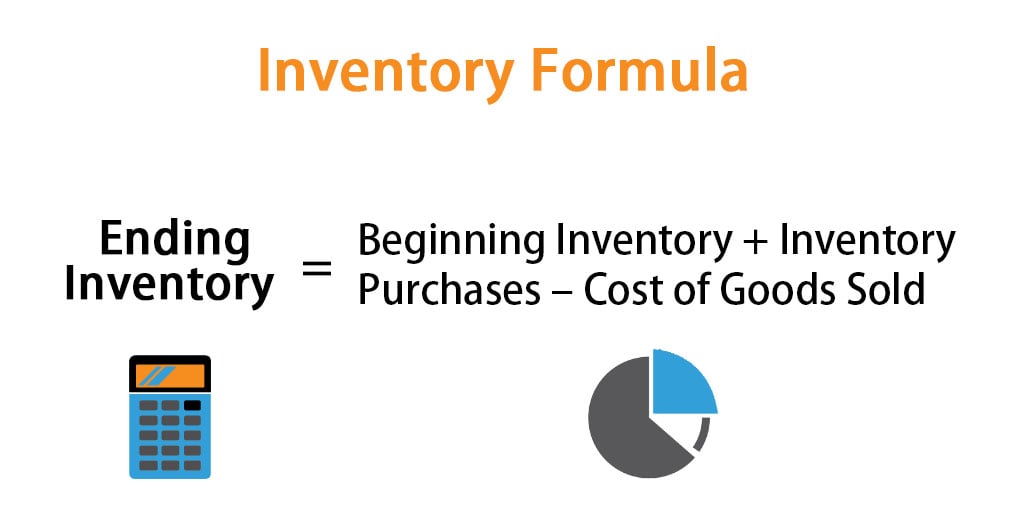

Beginning Inventory Formula COGS Ending Inventory Purchases. Work-in-Process Inventory Formula. Beginning WIP Inventory Manufacturing Costs COGM Ending WIP Inventory.

Determine the cost of goods sold COGS with the help of your previous accounting periods records. Beginning work in process inventory. Total Cost Of Work In Process Formula.

WIP b beginning work in process. Below is the data table. COGS Previous accounting period beginning inventory previous accounting period purchases previous accounting period ending inventory.

Beginning WIP Inventory Manufacturing Costs Cost of Finished Goods Ending WIP Inventory. Ending Work in Progress WIP Beginning WIP Manufacturing Costs Cost of Goods Manufactured. Assume Company A manufactures perfume.

Heres how youll need to do it. Its particularly important to monitor supply chain efficiency in a time of unprecedented supply chain disruptions leading to raw material shortages and extended lead times. WIP Inventory Example 2.

During the year 150000 is spent on manufacturing costs along with your total cost of finished goods being 205000. Inventory Formula Example 1. Relevance and Use of Cost of Goods Manufactured Formula.

Work in process beginning WIP manufacturing costs - cost of goods produced. How to Calculate the Beginning Work-in-Process Inventory The manufacturing costs incurred in this quarter are 200000 and the cost of manufactured goods is 100000. It is generally considered a manufacturing best practice to minimize the amount of work-in-process in the production area.

In this case for example consider any manufactured goods as work in process. C m cost of manufacturing. Use the following process to estimate the total effort required for your project In this equation WIP e ending work in process.

WIP inventory includes the cost of raw materials labor and overhead costs needed to manufacture a finished product. Work-in-progress as mentioned above is sometimes used to refer toassetsthat require a considerable amount of time to complete such as consulting or. To calculate beginning WIP inventory determine the ending WIPs inventory from the prior period and bring it over as the beginning figure of the new financial period.

Ending work-in-process 500 beginning work-in-process inventory 1700 total manufacturing costs for the period - 1500 total cost of goods manufactured. The formula for calculating beginning inventory is. Author Anfisa Dmitrieva Posted on.

500000 250000 350000 400000. Lets calculate Company As ending WIP inventory as per the formula. The last quarters ending work in process inventory stands at 10000.

To calculate the WIP precisely you would have to count each inventory item and determine the valuation accordingly manually. The closing carrying balance is carried forward as the beginning balance for the next period. WIP is calculated as a sum of WIP inventory total direct labor costs and allocated overhead costs.

Fortunately you can use the work-in-process formula to determine an accurate estimate. One highly important reason businesses calculate work in. Work In-process Inventory Example.

Beginning work-in-process inventory involves determining the value of products that are in production but that have not yet been completed at the end of an accounting period. Any raw material inventory that has been combined with human labor but is not yet finished goods inventory is work in process inventory. Beginning work in process inventory.

Manufacturing Account Format Double Entry Bookkeeping

Solved 1 Chapter 4 Applying Excel 2 3 Data 4 Beginning Work Chegg Com

Cost Of Goods Manufactured Formula Examples With Excel Template

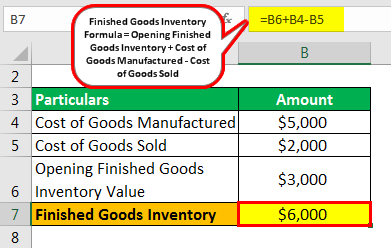

Finished Goods Inventory How To Calculate Finished Goods Inventory

Average Inventory Formula How To Calculate With Examples

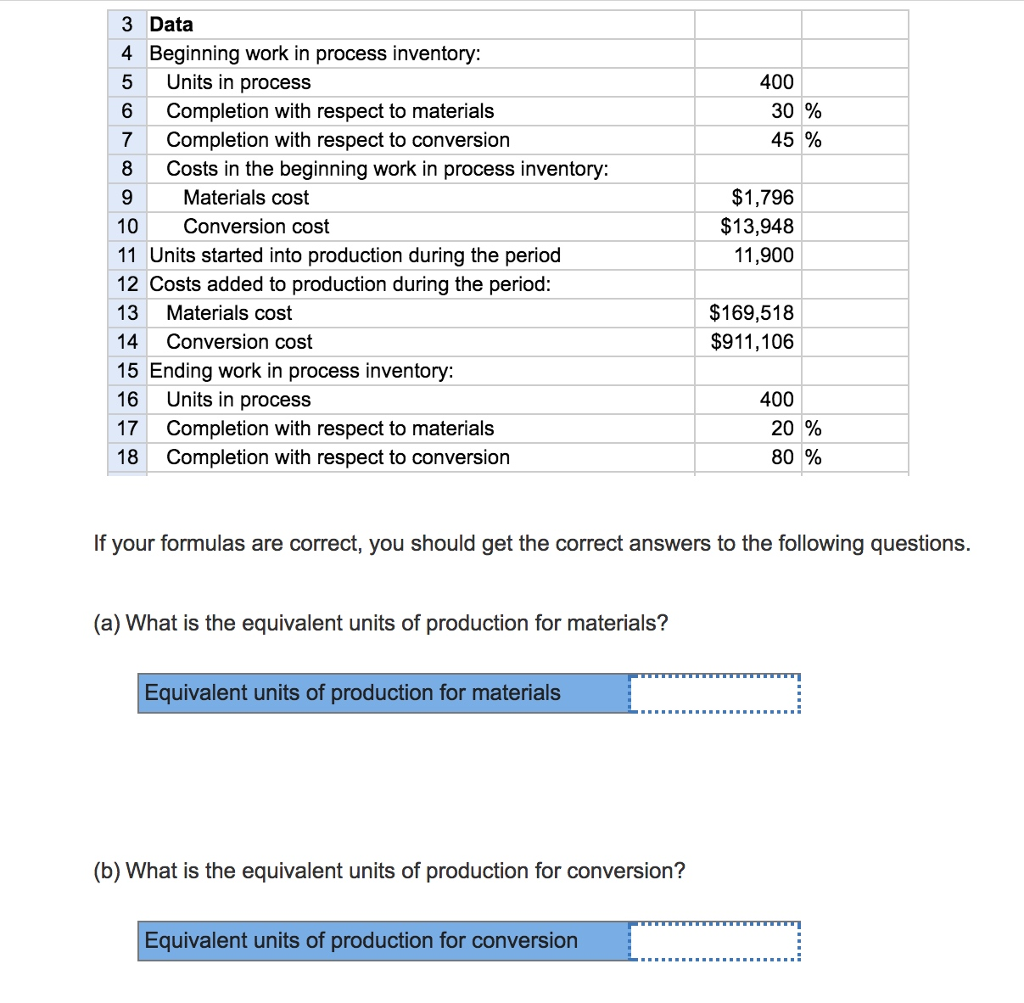

Solved 3 Data 4 Beginning Work In Process Inventory 5units Chegg Com

Work In Progress Wip Definition Example Finance Strategists

Wip Inventory Definition Examples Of Work In Progress Inventory

Cost Of Goods Manufactured Formula Examples With Excel Template

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com

Work In Process Wip Inventory Youtube

Work In Progress Wip What Is It

Finished Goods Inventory How To Calculate Finished Goods Inventory

Beginning Work In Process Inventory Business Accounting

Inventory Formula Inventory Calculator Excel Template